It’s Getting Harder to Ignore the Pain of Securities Identification

The pain of managing multiple securities identifiers remains a common problem for market participants across asset classes. But the use of open data solutions, such as the Financial Instrument Global Identifier, slowly is increasing. TABB Group head of fintech research Monica Summerville looks at trends in the securities identification space, barriers to the industry’s adoption of an open standard, drivers pushing the industry to identify a solution, and why FIGI is a leading contender.

POSTED Wed Dec 18, 2019

Click here to view full Tabb Report after free sign up process.

For the third year in a row, TABB Group surveyed more than 100 senior data leaders across the globe to get their views on the topic of instrument identification in order to identify key trends in securities identification practices. Over the past three years we found that, while managing multiple securities identifiers remains the standard situation for most market participants, use of open data solutions is growing.

Specifically, we found a steady climb in the use of the Financial Instrument Global Identifier (FIGI), the framework that standardizes the way financial securities are globally identified. FIGIs apply to all financial instruments across all asset classes in the financial sector and are open-sourced, non-proprietary, consistent identifies available for regulatory reporting.

TABB Group outreach over the past three years indicates several high-level securities identification trends:

- There is a heightened awareness by industry consumers that instrument identification presents many challenges.

- Support for an open data solution, with support for FIGI, in particular, continues to trend upward, but there is concern over whether critical mass will be achieved.

- Support for choice in identifier usage is growing; however, support for specific mandates by regulators may be waning.

- There is a developing disconnect between industry consumers and infrastructure players/policymakers on key issues such as the challenges posed by the use of multiple securities identifiers.

The key takeaways from TABB’s latest research include:

- Whether through fragmentation or greater awareness, firms are using more than one instrument identifier in higher numbers.

- There is a disconnect between the broader industry versus regulators, central securities depositories (CSDs) and exchanges with regard to policy decisions that affect identification data and standards.

- There continues to be a steady climb in use of the Financial Instrument Global Identifier (FIGI).

- There continues to be an even split between firms that endorse mandates and those that are against specific mandates/mandates in general.

Growing Use of Open Solutions – But Overall Adoption Remains Restrained

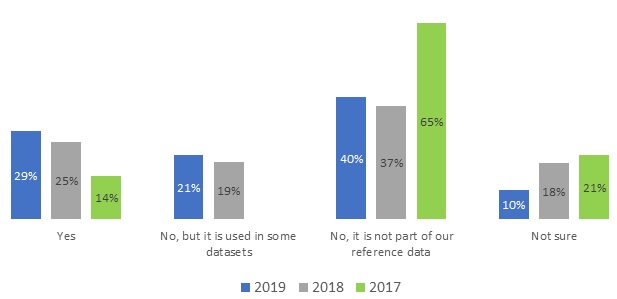

TABB’s latest survey shows growing use of open data and solutions such as FIGI. The three-year trend indicates year-over-year increases both in active and passive use (see Exhibit 2, below). Meanwhile, awareness of FIGI overall is up significantly.

Exhibit 1: Three-year trend shows steady climb in use of FIGI. (survey Q: ‘Do you currently use the FIGI in your operation?’)

Source: TABB Group

Note: The response ‘No, but it is used in some datasets,’ was not provided in 2017.

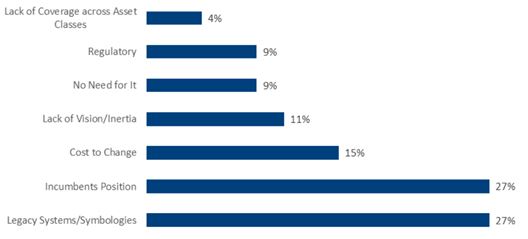

Despite the growing use of open solutions, however, overall adoption of FIGI remains restrained, with about half of outreach respondents either not using or unaware of the use of FIGI. Outreach participants cited two reasons as the top barriers to adoption: the current incumbents’ position in the market and legacy systems/symbology. Together these two reasons accounted for more than half the responses (54%). Cost was a distant third place, at 15% (see exhibit 2, below).

Exhibit 2: The majority of participants blame incumbents and legacy issues for slow adoption of an open standard. (survey Q: ‘What do you feel is the biggest barrier to the industry’s adoption of an open standard?’)

Source: TABB Group

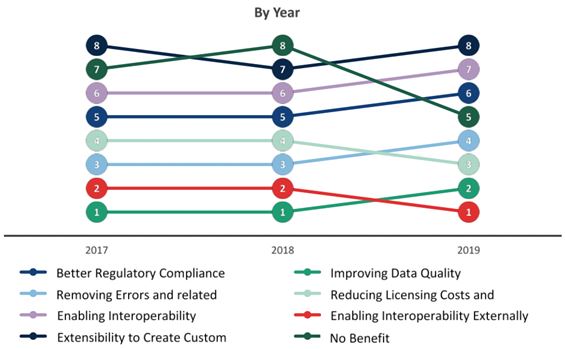

TABB Group asked the industry to rank the drivers for adopting a unique, open, license-free, perpetual ID for the industry (see Exhibit 3, below). Over the past three years the same four drivers held the top spots – with slight shifts from one year to the next. This year, enabling external interoperability became the No. 1 driver, overtaking data quality improvement, which dropped to second. Reducing licensing costs and the need to remove errors and related costs placed third and fourth, respectively, swapping places from 2018.

Exhibit 3: Interoperability is the main driver for adoption. (survey Q: ‘What do you see as the biggest drivers for adopting a unique, open-source, non-changing and perpetual identifier? Select your top three.’)

Source: TABB Group

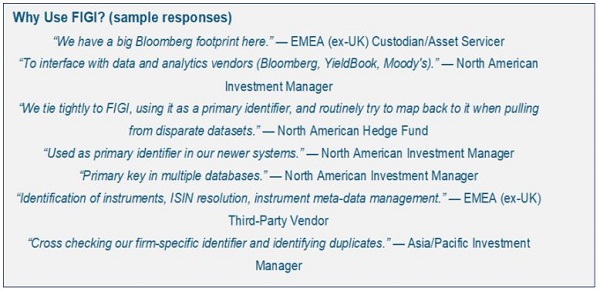

Why FIGI?

As part of TABB’s outreach we asked those respondents who already have adopted FIGI to explain why they made this choice. Four main themes emerged:

- Use of FIGI as a cross reference to map instruments with and without other identifiers, especially across disparate datasets. (This answer was cited by the largest group of respondents.)

- Adoption due to a Bloomberg footprint. Bloomberg is the registration authority for the FIGI standard, and it is included in standard data feeds from the vendor. Note that FIGI also is made available to non-Bloomberg users via the OpenFIGI website.

- Use of FIGI as a primary identifier.

- Use related to cost and licensing issues.

Passions run high

The topic of industry identification evoked as passionate responses in 2019 as it did in the previous two years. Given the expense to the industry, that is easy to understand. Infrastructure, specifically databases and legacy systems, rely on identifiers that were hard coded in the past and thus resist change.

The results of TABB’s outreach indicate that industry cooperation and communication in working toward change is somewhat lacking. The results highlighted conflicts among vendors and a clear disconnect between the industry and infrastructure players. This needs to be improved. Meanwhile, operationally, there is a growing awareness that something as innocuous as an identifier can have a real impact — operationally and economically.

Concerns and Opportunities

Overall, our outreach identified a number of concerns and opportunities regarding open standards:

Concerns:

- A tendency to look for a silver bullet solution may be causing inaction.

- A focus on singular mandates conflicts with the realities of the industry’s data needs.

- End-user perception of data vendors has not changed significantly despite efforts by some vendors.

Opportunities:

- Open standards show promise in addressing cost drivers.

- Multiple security masters and identifiers may not be the core problem.

- Focus on interoperable solutions as opposed to migrating to/mandating single solutions.

- Support for community-driven efforts is growing.

Survey Demographics

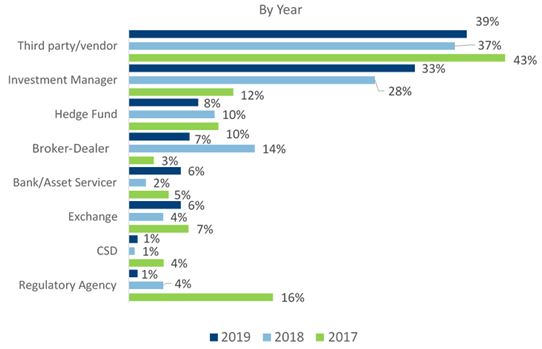

The kinds of firms surveyed this year remained largely consistent with the 2017 and 2018 surveys although we have had a steady drop in response from regulators (see Exhibit 4). Participation by investment managers and the third-party/vendor category increased slightly this year, indicating a greater participation by the wider industry. Almost half the sample was from regulated firms such as brokers, exchanges and investment managers.

Exhibit 4: Survey Demographics by Type of Firm

Source: Tabb Group

To learn more about instrument identification trends and access our latest outreach on the topic, please contact TABB Group for information on Monica Summerville’s latest report, “Opening Up Securities Identification Practices.”

TabbFORUM is an open community that provides a platform for capital markets professionals to share their ideas and thought leadership with their peers. The views and opinions expressed are solely those of the author(s). They do not necessarily reflect the opinions of TABB Group, its analysts, TabbFORUM and its editors, or their employees, affiliates and partners.