Overview

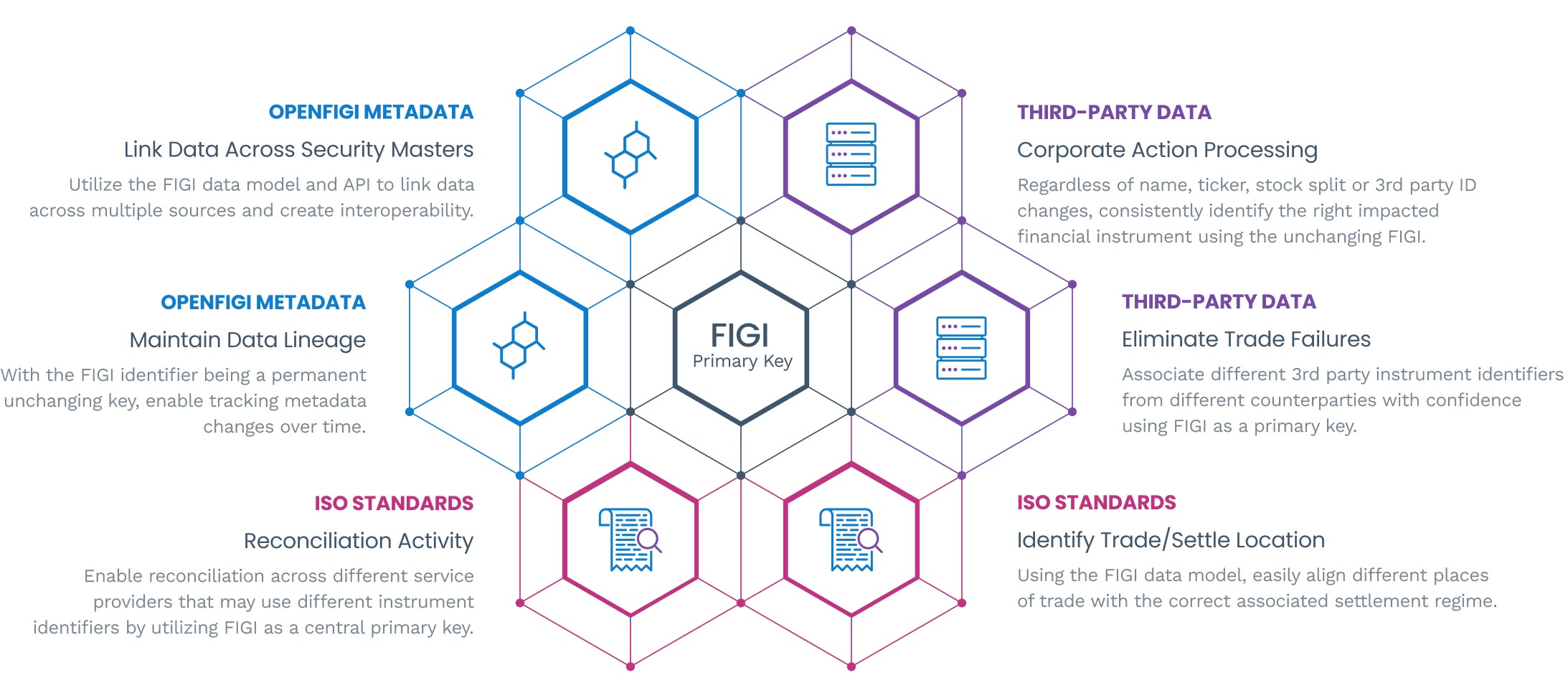

The Financial Instrument Global Identifier (FIGI) is an established global standard issued under The Object Management Group (OMG.org, an international, non-profit standards organization), founded in 1989. It is a 12 character, alphanumeric, randomly generated ID covering hundreds of millions of active and inactive instruments. In total, there are over 300 trillion potential identifiers available. The identifier itself acts as a Uniform Resource Identifier (URI) to link to a set of metadata that uniquely and clearly describes the instrument. This method of constructing symbols was chosen to satisfy the majority of client feedback, which demonstrated the need for a random sequence that produces a unique, non-changing symbol. FIGI closes the gap in existing symbology systems. Providing coverage across all global asset classes, real-time availability, and flexibility for use in multiple functions, firms are able to tie together disparate and fragmented symbologies, eliminate redundant mapping processes, streamline the trade workflow and reduce operational risk. FIGI also fills in the gap for asset classes that do not normally have a global identifier, including loans, cryptocurrencies and pairs on exchanges, futures and options.

Why FIGI?

Permanent

Once a FIGI is assigned, it never changes throughout the trade lifecycle. If the financial instrument referenced by a FIGI ceases to exist, the FIGI assigned to it is retired and never reused, but still accessible.

Semantically Meaningless

The FIGI code itself contains no information about the instrument or the issuer of the instrument. All semantically meaningful data about financial instruments is captured through Metadata associated with the FIGI. The metadata is both extensible and malleable.

Contextual and Self-Referencing

The FIGI framework establishes multiple relationships between different functional contexts (and associated metadata) of the same instrument. This enables consistent data quality when multiple use cases require different points of view, different associated metadata and use of different identifiers, such as a single obligation versus that obligation on multiple specific exchanges, or different regulatory reporting requirements dependent upon marketplace.

Governance

“OPEN” refers to being an open data standard. FIGI is the first and only open data standard for the unique identification of financial instruments. Open data is born from the core principles of the open source movement--that a piece of data is open if anyone is free to use, reuse and redistribute it.

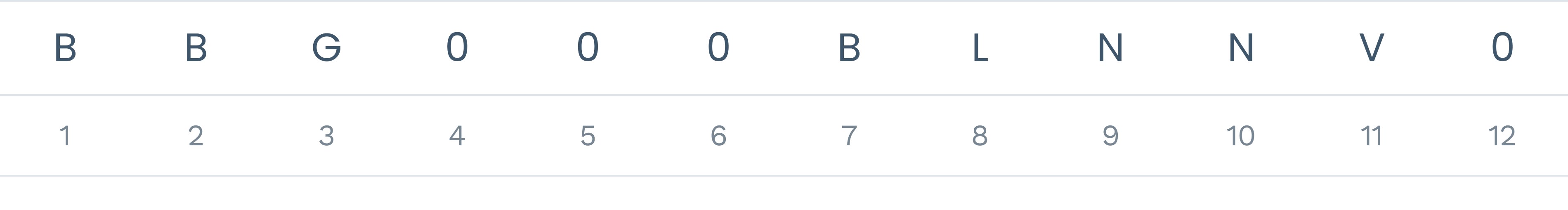

FIGI Structure

Characters 1-2: Designates the Certified Provider that issued (minted) the corresponding FIGI

Characters 3: Always 'G' to designate it as a Global Identifier

Characters 4-11: Randomly assigned values that complete the reference ID for the set of associated metadata. Alpha-numeric values allowed, excluding vowels.

Characters 12: Check digit formula is based on the Modulus 10 Double Add Double technique and will be applied to every FIGI number.

What is Open Symbology?

Symbology is more than just a code. It is a methodology and system that includes metadata. This not only describes the code, but how the descriptive data is related to other points in the dataset, and how to interoperate and include additional information. FIGI is the first and only open data standard for identification of financial instruments. Open data is born from the core principles of the open source movement – that a piece of data is open if anyone is free to use, reuse, and redistribute it — subject only, at most, to the requirement to attribute and/or share-alike. FIGI is a standard of the Object Management Group (OMG.org, an international, non-profit standards organization). The MIT Open Source declaration is embedded in the standard, ensuring it's status as Open Data in perpetuity. Bloomberg, as Registration Authority, holds true to these principles for the public good.

EXTERNAL LINKS

DOCUMENTS

- FIGI Check Digit

- FIGI Allocation Rules

- Exchange Codes