Will you have your ISIN, CFI and FISN for Jan 3 2018?

Come January 3, 2018, data issues with ISIN, CFI and FISN may come knocking. And end up impacting firms in ways they didn't anticipate or plan for.

POSTED Wed Dec 20, 2017

Over the past 2 years, since the publication of RTS23 that introduced mandated use of ISIN, CFI and FISN for regulatory reporting, I have covered issues with that mandate, and why it should be removed to be made more inclusive and open.

Now we are faced with practical reality. Not promises, theory, or wishful hope. This is not about petty politics or disingenuous propaganda meant to placate and obfuscate the truth. It is about proper functioning of global markets. And that should concern us all.

Over the past 2 years, we have been distracted by the creation of the Derivatives Service Bureau (which I will not address in this post), and been provided assurances by ANNA that the ANNA Service Bureau (ASB) - responsible for all listed instruments' ISIN, CFI and FISN - would have complete coverage and be ready for January 3, 2018.

(Reminder; ANNA Service Bureau and the Derivatives Service Bureau are two completely different entities, with different roles and structures.)

MiFID II instrument reference data requires FISN and CFI codes to be submitted in addition to ISINs. In early 2017 the Association of National Numbering Agencies (ANNA) promised the industry that its individual NNA members would deliver the data necessary for the industry to comply with the MiFID II mandate.

"1 July 2017 as the date that the updated Classification of Financial Instruments standard (CFI – ISO 10962:2015) and Financial Instrument Short Name standard (FISN — ISO 18774:2015) will be adopted and allocated to financial instruments.

The updated CFI and FISN codes will be assigned simultaneous with allocation of the International Securities Identification Number (ISIN) to new financial instruments. They will also be allocated to all currently active ISINs." (ANNA press release)

Note that ANNA promised the regulators that there was already complete coverage back in 2014, which was the underlying reason for the mandate to begin with.

With 2 weeks to go, where are we?

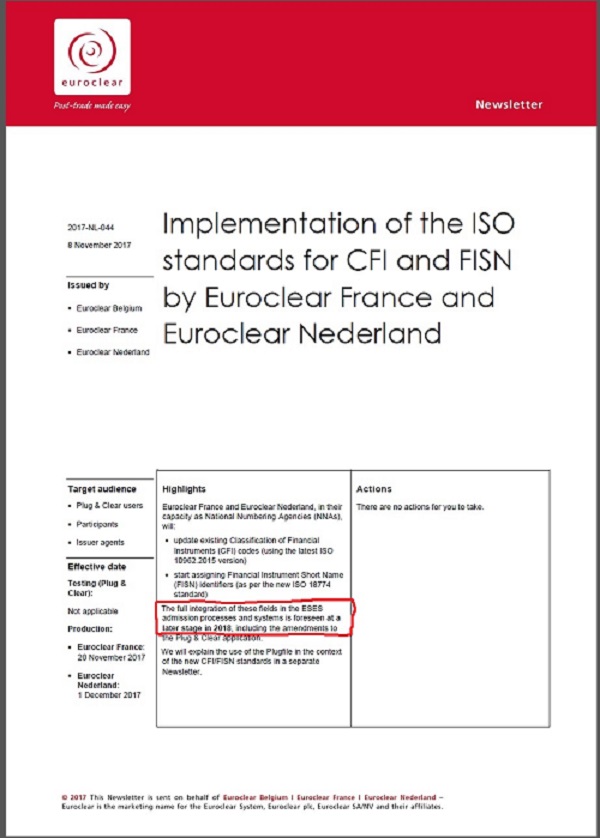

As of last week (December 15, 2017), it is clear that the July date was not met, even among the 28 countries within the EU mandate. Euroclear France and Euroclear Netherlands issued a newsletter (see insert) to that effect in November. And it is not completely clear if the newsletter indicates full availability by January 3 or 'a later stage in 2018'.

What we do know is this:

- As late as December 18, NL and FR based ISINs had not been updated, once again missing posted production ready dates.

- Data has shown that there are still gaps in CFI and FISN being assigned globally, and in some cases, significant gaps (approximately 500,000 FISNs missing, for example).

- Even if the gaps for currently issued ISINs missing CFI and FISN is filled - questions beg on why it took 3 years, and up until 1 week before that data is required, and only after widespread industry-led complaints. Ongoing quality and completeness will be questionable.

- ANNA's own Annual Reports, as recent as 2016, (which links have been pulled from their website in the past 6-12 months (deeplink for 2014, 2016 available in pdf offline - contact me directly)) have consistently indicated 'data quality issues' with its members as a ongoing and significant issue.

- Where CFI is being assigned, 2001 version CFI's remain throughout the ASB dataset globally and have not been updated to 2015.

- There is a lack of ISIN assignment for listed products, notably listed futures and options. Assignment that does take place can vary from NNA to NNA, such as some NNA's that do not assign by individual strike while others do. Indices are another concern.

- Focus has been on EU markets. But MiFID II data mandates apply to any instrument traded - and ISINs have not been assigned universally to all listed instruments that may need to be reported across the globe

- There are data quality issues raised that remain unaddressed in specific EU markets. (see my previous analysis regarding the Czech Republic), as well as non-EU markets.

- Use of ISIN in much of the rule determinations causes unintended consequences, especially around extraterritoriality when dealing with multi-listed common stock, and creating de-facto monetary policy that wasn't legislated.

- There are clear issues, either timing or infrastructure, where NNA's update data for CFI and FISN, and there is a noticeable delay in that data being available from the ASB, resulting in data reported via reference data requirements and ASB data being different.

I'm not against the use of ISIN, CFI and FISN - where they exist and are appropriate. I have been a vocal critic of the mandate, however. Because no single standard, nor one single entity can provide all the variations needed to accurately represent financial instruments, in all contexts, for all use cases and potential use cases, nor be able to manage the data quality across that universe. Competition breeds quality. And in data, that is especially important.

Standards don't exist in a vacuum, either. Implementation matters - NNA's in their numbering agency function are not regulated entities (regardless of inferences otherwise), nor are they consistently the same type of firm. Additionally, ISIN (ISO:6166) was traditionally looked at as a way to normalize instrument identification for settlement purposes (which is reflected by a majority of NNA's being Depository and reference data vendor type firms). Any standard understandably carries the biases of those that created it.

A high proportion of ESMA's reporting requirements are focused on more front-office transparency issues, where ISIN (and CFI and FISN) was never a major data point (as opposed to non-ISO exchange-specific tickers and market data). This means the ISIN data creation, management, assignment and distribution is based on processes, procedures and prejudices of the back office and local market settlement. (Which in and of itself is not bad or wrong. It just is, and should be an important consideration).

Context in data is critical, and the mandate for using ISIN, CFI and FISN did not consider context. And ESMA and legislators were misinformed by members of the industry, regardless if it was because of unconscious bias or otherwise.

Come January 3, it is clear that

- You will not have ISINs for some of the instruments you want to trade globally.

- If you have something referred to as an 'ISIN', it may not actually, in fact, be an ISIN (ISO6166)

- Even if you have an ISIN, you may not have CFI and FISN.

- You may have all 3, yet not be able to trade it where you want (but legally should be) - or not be able to trade it at all.

Not because it is improper to trade, or is something that was intended to be excluded. But simply because the underlying data identification theory behind ISIN does not fit for what ESMA and the EU intended to address.

Identifying something properly, within the right context, is a deceptively complex art, even before you add in use and relationships. It seems like it should be the most simple thing to do, and the least of things to worry about. That incorrect assumption has created a false premise that all later decisions and arguments for the ESMA data mandate(s) have been made on.

This goes far beyond just ISIN, CFI and FISN. Currency and denominations, venue identification - all of these things are going to have negative unintended impacts come January 3.

Will any of this actually affect you or have any noticeable impact? Who knows. Hopefully it's just an anomaly and no lasting impacts occur. But it is unfortunate that we are here with large unanswered questions, 2 weeks before go-live, and over a time period of code freezes, vacations, and holidays. Good intentions are not a substitute for knowledgeable data decisions.

Paving the road, and all that. My New Year's hope is that I am not the boy who cried wolf, and this turns out to be so much hullabaloo. Until then, God speed, and see you on January 4, 2018.

(as a final FYI, do NOT use isin [dot] com/org/net for your ISIN-related needs, as it is not affiliated with ISO (iso.org) or ANNA (anna-web.org). But do feel free to come check out OpenFIGI.com and we can likely help you out.)

Full article: Click here